About Us

Farm Infinity or farm∞ ® is a one-stop agri-fintech solution for a farmer's financial needs. Farm Infinity provides a digital platform to facilitate easy access of affordable financial services to farmers, Farmer Collectives (FPC/FPOs) and agribusinesses.

- Farm & Crop Loan

- Crop & Livestock Insurance (Cattle & Pig)

- Creditworthiness Report & Scorecard

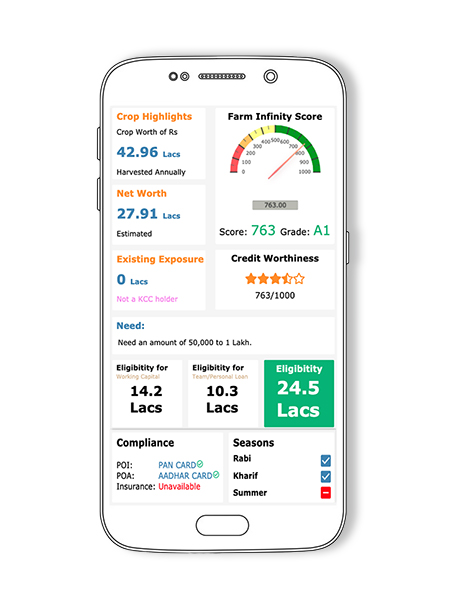

The company, Farmeasy Technologies (P) Ltd. has created patented proprietary algorithm to determine credit worthiness of farmers by evaluating multiple parameters of a individual farmer and analysing it from government database. These credit scorecard assessment reports help the BFSI sector make informed decision on providing lending & insurance products/services and reducing their NPAs.

Small & marginal farmers across Northeast India.

82% of our portfolio has women beneficiaries.

80% of our smallholder farmer borrowers are New-to-credit.

Years of collective experience of the team that developed the solution.

Services

We provide various financial services to farmers, farmer collectives and agribusinesses.

Easy Access

Multi-lingual mobile based online application form that can be filled by any smallholder farmer or educated youth known to the farmer. Works on low-end smartphones too.

Affordable

Our platform provides affordable financial solution to small holder farmers & agri-businesses, that enables them to improve their income generation capabilities.

Data Driven

Our platform captures multiple parameters of each farmer. Such data is useful to determine networth and creditworthiness and mitigate financial risks.

Reduced NPA

Our proprietary algorithm based patented creditworthiness scorecard does automated risk assessment and analysis of each loan application to reduce NPAs.

Agriculture Loan

We provide affordable farm, crop and livestock loans to small holder farmers through our financial partners.

Crop & Livestock Insurance

We provide affordable Crop and Livestock insurances (Cattle & Pig) from the best Insurance companies in India.

Creditworthiness Scorecard

Proprietory algorithm based patented creditworthiness scorecard to determine financial health of a farmer.

BaaS

Banking-as-a-Service (BaaS) to our financial partners for real-time monitoring of their Loan Asset & Portfolio.

Features

Mobile application and Dashboard based digital platform.

Pathfinders

Passionate people working towards betterment of the farmer community

Gunajit Brahma

Founder

Kaustav Gayon

Operations Manager

Ram Munda

Product Manager

Abu Naser M. Ahmed

Asst. Manager - OperationsSpearheaders

Industry leaders spearheading the path

Hemanta Narzary

Director; Retd. IAS Officer

Dr. Samir Baruah

Add. Director; Retd. Banker

Vinay Peshwa

Ex-Infosys, FinacleFrequently Asked Questions

What is Farm Infinity?

Farm Infinity is a digital platform to connect farmers to financial institutions such as Banks, NBFCs, MFIs, etc. for availing financial services like loans, insurances, etc. at an affordable rate.

Who can avail Farm Infinity services?

Any farmer collectives like FPOs, FPCs, SHGs, JLGs, Farmer Co-op Society, etc. can register themselves on our website for financial products like loans and insurance. The farmer members can directly download our mobile app from Google Playstore and apply for loans.

How to partner with Farm Infinity?

Lending institutions please get in touch by writing to us at info[at]farminfinity[dot]com. Farmers who seek agricultural loans can register directly through the Farm Infinity android mobile app. Farmer collective seeking loans like FPO/FPCs can register by filling the FPO form. If you are an individual and willing to contribute towards financial inclusion of the farmers, please register as an Field Agent using the agent form.

How institutions like Banks and Insurance benefit from Farm Infinity?

Farm Infinity through its mobile app makes customer acquisition through digital process and at a reduced cost. The insurance and lending institutions can reduce the risk of fraud, default & NPAs though our solution. Our BaaS offering with digital dashboard, credit scorecard and credit assessment report will automate most of the underwriting processes and help these institution to reduce the risk of the financial offering.

Who will provide the financial products (like loan, insurance)?

The financial products are provided by the scheduled banks in India including the public sector banks (PSBs), Co-operative banks, regional rural banks (RRBs) and commercial banks. Other institutions that provides financial products and services through the FarmInfinity platform are Non-banking Financial Companies (NBFCs) & Microfinance Institutions (MFIs). Farm Infinity does not deal with any unregistered lending institutions.

What is Farm Infinity Score and Credit Assessment Report (CAR)?

Farm Infinity uses data provided by a farmer, to generate a score based on its proprietary algorithm. The Farm Infinity score ranges from 0 to 1000 depending on the farmer profile. The Credit Assessment Report (CAR) is a digital report which contains farmer profile, farm infinity score, grade and eligibility. Based on the CAR, the financial institution like Banks, NBFCs, etc. can provide financial products like crop loans, crop insurance, livestock insurance, etc.

What are the charges and fees associated with Farm Infinity services?

As of now, Farm Infinity does not charge its customers who register on the platform. The processing fees as applicable at the time of disbursement of any kind of loan or other financial product/service, will be collected by the financial institutions.

What is the interest rate charged for loans?

The interest rate for loans is as per standard rates offered by Banks and other lending institutions. The interest rate may vary depending on the risk profile of the applicant.

Contact Us

Farmeasy Technologies (P) Ltd.

Facilitate easy access to affordable financial services to small and marginal farmers and agribusinesses. Reducing the risk of NPAs (non-performing assets) and improved repayment of loan for the BFSI sector.